11 Painful Life and Business Lessons from 2011

I'm not ashamed to admit it… 2011 has been one hell of a roller coaster ride for me.

This is the year I almost went bankrupt; discovered who my true friends are; And experienced the Love of God as well as kindness, love and hope from complete strangers.

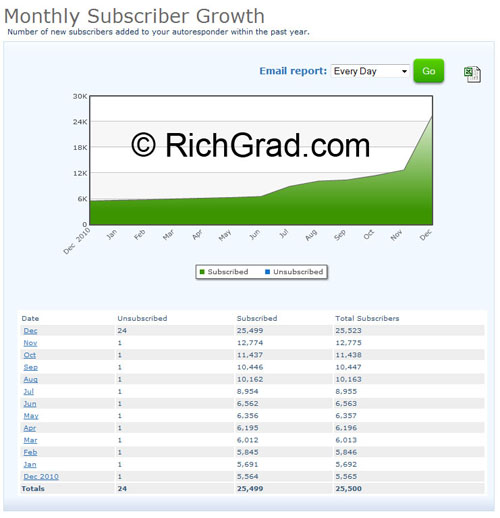

This is also the year I achieved my goal of touching at least a million lives by the time I hit 30; Started a facebook community called “101 Powerful Affirmations” (based on the eBook I wrote by the same name) with the intention of making a positive difference to the world and built up a following of more than 10,000 fans in 2 months; And quadrupled my personal development email newsletter subscribers from less than 5,600 in Dec 2010 to over 25,000 now, allowing me to touch more lives with each and every message I send out.

What I'm going to share with you today is something that I've not made known publicly previously. It's something only a few of my close friends know. And although I still feel a little apprehensive sharing it, I believe ultimately that this is going to benefit anyone who has ever experienced massive success and gotten complacent (a highly dangerous position to be in) as well as to prevent anyone from making the same mistakes I did so here goes nothing…

I know many of you know that I've gone from oweing a 5 figure debt (in 2007) to making a 6 figure passive income from internet marketing (in 2009). I've talked about it in my 101 Powerful Affirmations eBook and this is an achievement that I've always been proud of.

What you may not know is that I've lost almost all of that money (and more) very recently… in August 2011 to be exact… and am back to a position where I've taken on a 5 figure loan/debt again (the irony of life! LOL…)

This was what happened…

Lesson 1: When you've achieved a certain level of success, you tend to get complacent. And that complacency is what's going to lead to your downfall.

In August 2011, the US debt-ceiling crisis happened.

And it wiped out almost my entire life savings.

What happened was that I took a huge risk/gamble by over-leveraging my stock positions in Bank of America (BAC) and another stock I was trading in (GMR). I thought that stocks would definitely rally after the US has increased the debt ceiling so I took on multiple contra positions and the worst part was I left the positions open while I went on holiday overseas.

This backfired on me.

When I got back from my mini-vacation, I found out that Standard & Poor's had downgraded the credit rating of US government bond (because they thought the US government's decision to raise the debt ceiling took too long) and this caused the US Stock market to plummet.

I lost more than US$100,000 in a matter of days.

I believe I landed myself into such a situation partly because of greed but mainly because of complacency.

I had let the financial success I've achieved from internet marketing get to my head… and probably believed that just because I am good at making money from one field/area, it means that I was good at making money in general, from any type of venture/investment I took on (like Stocks and Trading). This episode proved that I was DEAD wrong.

And I paid a heavy price to learn this lesson.

Lesson 2: Never rely on just one major (income or traffic) source/person

2011 hasn't been the best year for me, financially speaking. Besides the stock losses which wiped out my savings, I was also coping with several business challenges.

One of them was that my google adwords account got permanently suspended, for no reason.

I was not the only one affected. Many internet marketers have had a similar experience and google wasn't very helpful in their response to the whole saga.

On top of that, the affiliate accounts generating me the most money were hacked… and I stopped receiving money from these accounts (They were 5 figure/month accounts)

I still receive passive internet income from other smaller streams but not as much as what I was getting before.

What I've learned is that unexpected things and situations happen all the time in life and in business, and instead of placing blame or getting upset about it, we just need to adapt. I've switched to using facebook and other sources to generate FREE traffic (what a blessing!). And for the ultra-profitable 5-figure/month affiliate accounts, I can't get them back since they were hacked but I'm gradually exploring other options and independent affiliate programs. With the internet marketing skills I have accumulated over the years, it's just a matter of time before I build up my internet business back to its former glory again.

Lesson 3: Stay away from toxic people. Surround yourself with positive people that lift you up.

When you lose almost everything, you realize who your TRUE friends are.

At that point (in August 2011), because the prices for the stocks I bought went down so fast and so much (coupled with the fact that I was contra-ing), cash flow became a major problem.

I had enough money to pay off the losses but most of my money were stuck in my Paypal account (It takes at least 5 days for money to be transferred from paypal to my Singapore bank account and I had to settle the losses in 3 days).

So I did what anybody would do at that moment – I called up close friends to ask for help.

I explained the situation and made it clear that I just needed a loan for a couple of days… and I asked this girl whom I thought I could trust if it were possible for her to make a loan to me if I needed it (if my paypal funds did not get transferred on time). She asked me to let her know the amount so she can decide and I told her I would get back to her.

I called her back but she didn't pick up.

I then texted her to let her know that it's alright… my paypal funds came through and I had settled my losses.

And I thought that was that.

Little did I know that some time later, she would use this against me, in a bid to smear my reputation (Her network is also made up of many successful multi-millionaires and many mutual friends)

She was saying that since I make so much money from internet marketing, why would I even need a loan and even resorted to name-calling saying I'm a liar etc. (When I had clearly explained the reason why)

Bear in mind that I didn't even borrow any money from her… I just asked if it were possible for her to make me a loan.

Anyway, I'm no longer friends with that girl… and no, I'm not going to mention names.

A mutual friend asked how I'm coping with this entire episode. I told him that betrayal hurts but I'm learning to move on. I wish this girl the best in whatever she does.

Lesson 4: Debt may not necessarily be bad

Actually, I'm thankful for my US$100,000+ losses from stocks speculation.

It humbled me by dealing me a hard slap on my face, “waking me up” as well as allowing me to see who my TRUE friends are.

Throughout the time when I was feeling really down, I'm glad I have other friends who have always stood by me… like my best gal friend Elsie Tay Lee Ping.

She was the one who introduced me to “Balance/Funds Transfer”. Basically, it's a relatively cheap way of getting a short term loan.

My standard Chartered Credit Card Limit is $26,000 and I managed to get a 6 months $25,000 loan (through Funds Transfer) for only 1% or $250.

This really helps me a lot with liquidity.

I have reinvested part of the money into the US stock market but this time I'm more cautious, having learned from my painful lesson. I'm only investing in proven stocks that have generated me positive results in the past and I watch over my portfolio like a hawk now.

As a result, I've been able to gradually reduce my overalll losses….

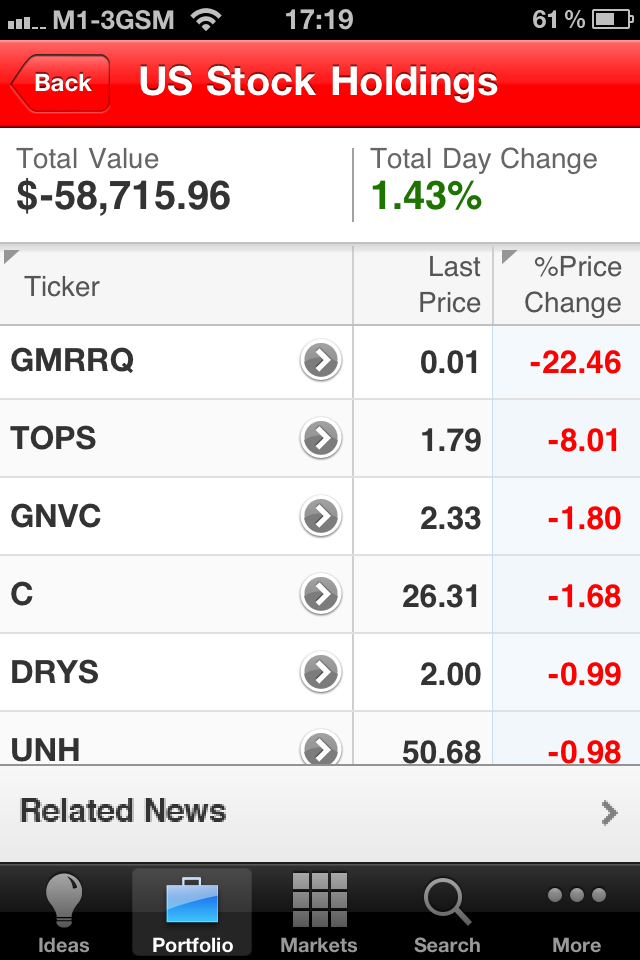

This is what my portfolio looks like now (It used to be +$30,000+ before the crash in August):

Debt is not always bad. Used wisely, it can be a pretty good form of leverage. As I mentioned before, it was the 5 figure debt that I took on in 2007, that has allowed me to invest in seminars to improve myself which resulted in the 6 figure income I accumulated in 2009.

Although it seems like I'm in a similar situation now like I was in 2007 (-ve 5 figures -> +6 figures -> -ve 5 figures), in reality, I know I'm at a different level now because I've grown so much and accumulated so many skills and I'm confident I will gain back what I've lost and more in due time.

Lesson 5: Your (life and financial) decisions don't only affect yourself. It affects others, like your family members

When I lost almost my entire life savings and was only left with 3 figures in my bank account some time this year, I actually wasn't feeling particularly upset.

Somehow I just know that I already have a 6 figure/year mindset so I'll definitely be able to make the money back and more, in time to come.

Also, almost all of the income that I've earned the past few years were passive income… which I didn't trade time, blood, sweat and tears for… so losing the money didn't have such a major impact on me.

However, when my mom found out what happened (I told my dad about it but asked him not to let my mom know but he did anyway), she freaked out and went on a hunger strike.

“If you wanted to throw money down the drain, you might as well have given it to me for safe-keeping!”, I remembered her saying.

I tried to explain to her that obviously my intention of putting money into the stock market was to grow it and I had no way of knowing about the impending market crash (else I would have sold off all my stock positions way before that).

Seeing her acting out in this way pained me and for the first time, I felt the pain of losing the money and the consequences of my rash financial decisions.

I usually bring my parents out at least once a week to watch a movie or have a good meal and because of my financial situation, my mom told me it's not necessary for me to continue doing so. She said… We can do so in future when you get your business and finances back up again.

I just told her “No, don't worry mom, God will take care of me. I will never go hungry, I will never live in lack. I don't know how to explain to you but this is what I believe. And life is what happens NOW. Not in the future. I can't be sure about the future… I can only be sure of what happens now. And right now I want to bring you to watch a good movie and eat a good meal like we usually do. You don't have to worry about the money. Everything will be taken care of”

Lesson 6: Stay Hungry, Stay Foolish

Now I finally understand what Steve Jobs meant when he said those wise words… Stay Hungry, Stay Foolish

The reason why I managed to get out of a 5 figure debt in 2007 to earn a 6 figure income in 2009 was because I was HUNGRY in 2007. I had left my job… I had gotten myself into a 5 figure debt (so as to pay for personal development seminars), my father was critically ill and I needed to make what I was doing (internet marketing) work. There was no other way than to succeed!

Then after, I've made the money… when I was enjoying 5 figure passive income cheques every month, I lost the hunger. I became complacent. I was traveling almost every month and partying every week. I steered away from my life mission of touching as many lives as I can so as to bring more love, hope and joy to the world.

Losing (almost) my entire life savings in August 2011 woke me up. It changed my entire perspective on money and on life. I decided to get back on track to fulfill my life purpose. I got hungry again and foolish as well. I know my first priority is to help people. Making money would come as a natural consequence… as long as I focus on giving massive value to as many people as I can… because money is ultimately just an exchange of value.

Lesson 7: Don't be afraid to go after your dreams, in spite of ridicule, criticism, possible humiliation and/or fear

This was one of the main driving forces that prompted me to set up 2 facebook communities (Free Daily Christian Affirmations and 101 Powerful Affirmations) in mid September 2011. My goal was to revolutionize facebook and make it more positive. I also wanted to have some sort of a forum/place where my subscribers would gather to motivate and inspire each other and share positive affirmations/quotes with each other and brighten each others' days.

In end October… I set a ridiculous goal… I told everyone I wanted to achieve 100,000 likes for 101 Powerful Affirmations in 2 months (by Christmas). My goal all along is 10,000 ‘likes' in 2 months but I have always heard you need to put another ‘0' behind whatever numeric goal you set… so I did… I even went back to my alma mater, NUS to give a talk about my goal. Some people thought I was crazy… others criticized me and asked what's the intention behind my goal even though I have already explained it many times. But I didn't care… I just pressed on… I was eating, sleeping, dreaming, talking, breathing 101 Powerful Affirmations.

By 15 Dec (before Christmas), we achieved my original goal of 10,000 ‘likes' in 2 months (by Christmas). As of this moment, the community has garnered over 12,000 likes and the positive affirmations and quotes there have been viewed and shared over 5 million times…

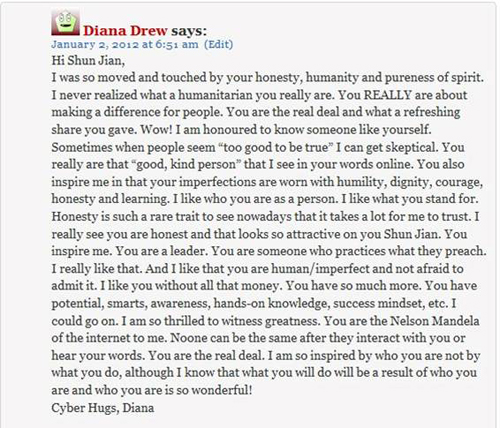

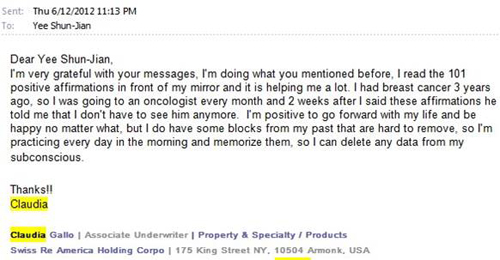

These are some of the testimonials I have received… (Click on image to enlarge… Post updated with recent testimonials)

I'm so happy that I have inspired so many people within such a short time. I'm also thankful for all the help I'm getting from complete strangers who believed in me, believed in the cause I was promoting and jumped on board to help me man 101 Powerful Affirmations.

Lesson 8: Thank God for Insurance

Not many people know this but I actually got into a car accident on 17 October 2011. I'm still going for treatment every now and then and my neck and back hurts every day. But I just pray every day that “By his stripes, I am healed”.

I've chalked up quite a huge bill from all the medical expenses. [Medical Bills Chalked up in a single visit ($756 in total)]

Thank God I am covered by insurance. If you live in Singapore and you want to get insurance (especially personal accident plan), please feel free to get in touch with my good friend and insurance agent Elsie Tay at +65 90995550

Lesson 9: My wealth is not measured by how much I have in my bank account but how much I've invested in my financial mindset

A person who has a lot of money in the bank but who's not prudent with it can lose it very easily (as I have shown you).

A person who may not have much money in the bank currently but who has the right mindset will accumulate the amount of money that's in his mind in time to come.

I'm not afraid to admit that right now, I may not in the best financial shape physically but mark my words, that will all turn around pretty soon… =)

Lesson 10: Be willing to invest in education/coaching no matter what level you're at

This is related to the previous lesson. I realized that no matter what level you're at now, you still need to invest in education/coaching so as to get to the next level. The most important thing you can ever invest in is your mindset because it's going to pay back multiple folds.

Lesson 11: Be grateful every day

Finally, be grateful every day for every thing. I'm very thankful to all the people I've attracted into my life as a result of starting 101 Powerful Affirmations… especially to all my ANGELS (my admins). I'm thankful to God for the lessons I've learned this year… and for providing for me so that I need never worry. I just do my best and God will do the rest.

I am thankful for the amazing results I've gotten this quarter… which I have mentioned in the beginning of this blog post.

2012 hasn't even started and it already looks set to be my BEST year ever. I have already secured two $200/hour Internet Marketing coaching clients for the first week of the year (excited to groom them into IM superstars!) , been invited to give talks and network with students/industry leaders from my Alma mater (NUS), received countless JV proposals/offers etc.

I know this has been a really long blog post and if you're still with me, I thank you for taking the time to read it. I hope you will seriously learn from the mistakes I've made (and not make them yourself) and I hope you have been inspired by how I've turned adversity into opportunities to close out this year with a positive ending.

Goodbye 2011 and Happy New Year 2012… I hope to inspire you more in this coming year =)

December 31, 2011 49 Comments